Unsecured Business Loan

Upgrade your business and take it to new-fangled heights with a capital infusion from Junoon Capital Services Pvt. Ltd. fast unsecured Business Loans. We offer offline as well as online Business Loan in India for the MSME sector and have designed our offering to match your unique needs. Junoon Capital Services Pvt. Ltd. offers business owners and entrepreneurs easy Business Loans in India, and quick, small Business Loan to ensure funding is never an obstacle when striving towards success.

Junoon Capital Services Pvt. Ltd. is between the best Business Loan lenders that provides an unsecured business loan offline and online both models to help needy businessman. The loan can be gotten without the need for any security or many documents. A primary benefit of an unsecured Business Loan is that it defends your company's assets. Furthermore, our unsecured Business Loan is easier to obtain and has faster turnaround times, ensuring that you have the funds you need on time. With this USP of ours, you get an easy Business Loan in India. Also, if you are looking at a smaller ticket size (lower loan amount), a small Business Loan from Junoon Capital Services Pvt. Ltd. is the product for you.

A regular Business Loan and a small Business Loan from Junoon Capital Services Pvt. Ltd. are very similar in their eligibility criteria, features and benefits, documentation requirement and so on. The only difference between the two is the ticket size.We have optimized every step of the way to promise a hassle-free and time-efficient experience. You can touch with our local branches as well as online, in just a few days, get Business Loan fast approval, and have the entire sanction disbursed just as quickly. You can rely on the Junoon Capital Services Pvt. Ltd. Business Loan in emergencies and never have to worry about lack of capital.

Various Business Loan Needs

You can apply to cover any business-related expense. Business owners can use the capital to:

- Fund business expansion or diversification

- Improve existing business set-up

- Boost ⦁ working capital reserves

- Purchase and stock inventory

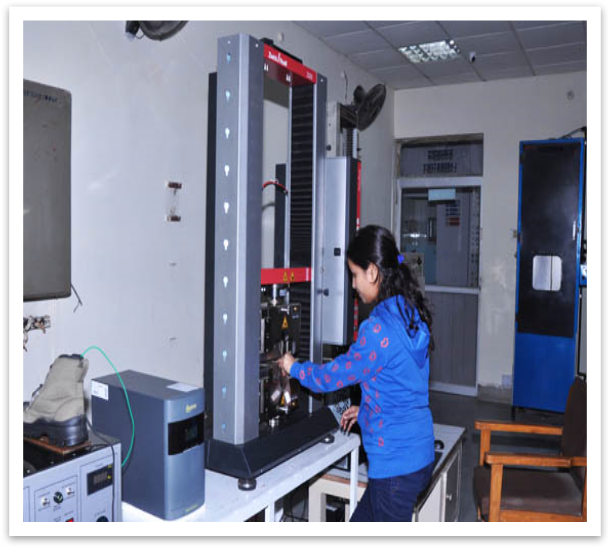

- Buy new machinery, equipment, stock

- Capitalize on business opportunities

A Business Loan with customer-friendly features & benefits

- Running a business successfully is a capital-intensive task. All enterprises incur a variety of expenses that must be made on time to ensure business operations. Having easy access to capital can make all the difference, especially when capitalizing on market opportunities.

- At Junoon Capital Services Pvt. Ltd., we understand these needs and offer the Secured ⦁ Business Loan as a viable solution for all entrepreneurs looking to stay competitive. Borrowers enjoy a countless of cost-effective advantages of taking a Business Loan.

Loan disbursal amounts

Business expenditures and working capital require sufficient finance. With our Business Loan, you can access capital up to ₹5 lakh and fund any business-related expense without compromise. It is one of the primary advantages of Unsecured Business Loan.

Faster and smooth disbursal

Faster and smooth disbursal is another Business Loan benefit. The Junoon Capital Services Pvt. Ltd. Business Loan is designed to suit your busy lifestyle and schedule. We offer quick loans online, ensuring you have a hassle-free experience whenever you need funds for your business. This is a key advantage of Business Loans, and we ensure a quick turnaround time to minimize delays.

Competitive interest rates

When you opt for the Junoon Capital Services Pvt. Ltd. Business Loan, you enjoy a competitive interest rate. Among the many Business Loan benefits, a low-interest rate makes our offering a cost-effective solution that you can rely on to maximise revenue.

Simplified documentation process

To minimise delays altogether and speed up loan processing, we only require you to submit basic Business Loan documents. This feature complements the ease of availing capital with Junoon Capital Services Pvt. Ltd. and offers you a swift and simple solution. Our speedy and simplified documental process gives an edge over other businesses seeking loans and therefore acts as another advantage of a Business Loan.

Extended loan tenure

Loan EMIs should never strain working capital reserves or cause you to dip into profits. With our Business Loan, you don’t have to worry about this as you can opt for a flexible tenure ranging up to 36 months. This helps you plan your repayment optimally based on your business’ cash flow.

Quick approvals

Delays, especially because of a lack of funding, can affect profits or cause losses in business. To ensure you never face this problem, we offer quick approvals on our Business Loan. Thanks to the online loan applications and quick processing, you can get an instant Business Loan.

Convenience of online process

The convenience of an online process is another Business Loan benefit. Get access to capital digitally and from the convenience of your home or office. Apply online in just 5 simple steps, get instant approval, and have the funds credited to your account without any delays.

Smart Ways to Use A Junoon Capital Services Pvt. Ltd. Business Loan

You can use the Business Loan for business growth or meet the short-term needs of your enterprise. Some of the smart ways to use this Business Loan are as follows.- Bolster working capital

- Manage operational cost

- Upgrade, maintain, repair, or purchase new machinery, software, and other assets

- Improve business infrastructure

- Hire trained, skilled staff

- Expand to newer markets

- Adopt new marketing or sales strategies

- Restock inventory

- Diversify your product/service portfolio

- Take your business online

How To Apply for A Junoon Capital Services Pvt. Ltd. Business Loan

- Step 1: Click on the ‘Enquiry Now’ button on our website.

- Step 2: Select Category

- Step 3: Enter basic information and submit

- Step 4: Our Customer Care will connect you and refer to Credit Team

- Step 5: Credit Team Contact you and process the loan.

- Customer

- Upto 2 years old Owned business

- Running a businesses

- Agreed to NACH/ECS and GEO tag Applicant/Business

- Agreed to NACH/ECS and Geo Tag of Business premises and Applicant House

-

Platform / T&C

- Offline/Branch

-

Loan-

- Loan upto 5.00 Lac

- Tenure Between 6 -36 Months

- Repayment- Monthly

- Processing Fee - 2 to 5%

- Documentation Fee - 1%

- Against hypothecation of stock

- Co-Borrower Guarantee

- Loan Credit Insurance

- Annual Percentage Rate 20% to 23%